The Top Attributes to Try To Find in a Secured Credit Card Singapore

The Top Attributes to Try To Find in a Secured Credit Card Singapore

Blog Article

Revealing the Possibility: Can Individuals Released From Personal Bankruptcy Acquire Credit History Cards?

Understanding the Impact of Bankruptcy

Bankruptcy can have an extensive effect on one's credit rating rating, making it challenging to access debt or loans in the future. This financial stain can remain on credit records for numerous years, affecting the person's ability to secure desirable rate of interest prices or economic opportunities.

Additionally, insolvency can limit job opportunity, as some employers carry out credit history checks as component of the employing process. This can pose a barrier to people looking for new job leads or job advancements. In general, the effect of insolvency expands beyond economic constraints, affecting different elements of a person's life.

Elements Impacting Credit History Card Approval

Adhering to bankruptcy, individuals usually have a low credit scores rating due to the adverse influence of the personal bankruptcy filing. Credit scores card business commonly look for a credit rating score that demonstrates the applicant's capacity to handle credit responsibly. By thoroughly thinking about these elements and taking steps to rebuild credit scores post-bankruptcy, individuals can enhance their prospects of getting a credit history card and working towards economic healing.

Steps to Rebuild Credit Scores After Bankruptcy

Reconstructing credit score after personal bankruptcy calls for a strategic approach concentrated on economic technique and regular financial obligation administration. One reliable technique is to obtain a secured credit report card, where you deposit a specific amount as security to develop a credit rating limit. In addition, take into consideration coming to be a licensed user on a family members participant's credit score card or checking out credit-builder financings to further increase your credit scores score.

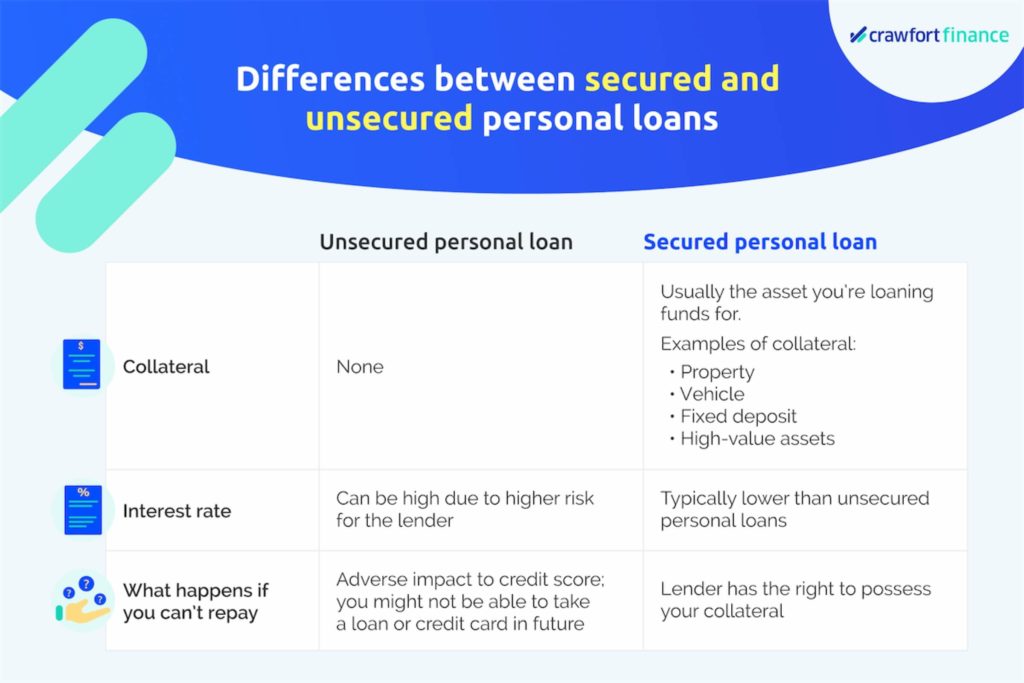

Safe Vs. Unsecured Credit History Cards

Complying with personal bankruptcy, individuals usually think about the choice between safeguarded and unsafe charge card as they aim to restore their creditworthiness and economic stability. Guaranteed charge card need a money down payment that works as security, commonly equal to the credit line provided. These cards are less complicated to obtain post-bankruptcy because the down payment minimizes the risk for the company. However, they might have higher fees and rate of interest compared to unsecured cards. On the other hand, unprotected charge card do not call for a down payment but are more challenging to get after personal bankruptcy. Providers evaluate the applicant's credit reliability and might offer lower fees and rates of interest for those with a good monetary standing. When making a decision in between the 2, individuals must consider the benefits this page of simpler approval with safe cards versus the potential costs, and think about unprotected cards for their lasting economic objectives, as they can help restore credit history without linking up funds in a deposit. Ultimately, the option between secured and unsafe credit rating cards should align with the person's monetary goals and ability to take care of you can check here credit rating sensibly.

Resources for People Looking For Credit Score Rebuilding

For people aiming to enhance their credit reliability post-bankruptcy, checking out available sources is critical to successfully browsing the credit report restoring process. secured credit card singapore. One useful source for individuals looking for credit score restoring is credit counseling companies. These companies provide financial education and learning, budgeting aid, and personalized debt improvement plans. By dealing with a credit history therapist, people can obtain understandings right into their credit history records, find out approaches to boost their credit history, and obtain guidance on managing their funds effectively.

One more practical resource is credit report monitoring solutions. These solutions enable people to keep a close eye on their credit score records, track any errors or modifications, and spot potential indications of identity burglary. By monitoring their credit report on a regular basis, individuals can proactively attend to any type of issues that might guarantee and develop that their credit report information is up to date and exact.

Moreover, online tools and sources such as credit history simulators, budgeting applications, and financial literacy sites click for more can supply individuals with beneficial info and devices to aid them in their credit score rebuilding journey. secured credit card singapore. By leveraging these resources properly, individuals discharged from insolvency can take meaningful steps in the direction of improving their credit score health and protecting a far better financial future

Final Thought

Finally, individuals released from insolvency may have the chance to acquire bank card by taking actions to restore their credit. Factors such as credit background, earnings, and debt-to-income proportion play a significant role in bank card authorization. By recognizing the influence of bankruptcy, choosing in between protected and unsafe charge card, and utilizing resources for credit scores rebuilding, people can boost their credit reliability and possibly acquire access to charge card.

By working with a credit scores counselor, people can obtain understandings into their credit history reports, learn strategies to enhance their debt ratings, and receive assistance on managing their funds properly. - secured credit card singapore

Report this page